Nowadays, we consume so much information in a day than we did before which is an increased exposure to cybercrime.

Most of us know that we need strong passwords for our personal information. We would never open an email we don’t know to be safe.

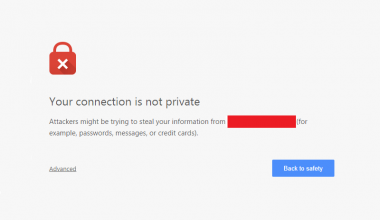

However, if a malicious “cafe shop hacker” does manage to compromise your computer or phone, it could be worse than you think.

Thieves can use your Social Security number (SSN)

to commit tax refund fraud by filing a bogus return in your name., The crooks can take out a bank loan in your name., spend using your credit cards and open up new utility accounts, etc.

But how can they get your personal information? Well, can you imagine a stranger sitting in front of your computer, going through your files? It’s as if they’re sitting in your computer chair, using your computer and seeing all of your data and files on your computer monitor. And you have no idea that this is going on.

A Skilled hacker could gain access to your Social Security number, your credit card numbers, your bank account…. What’s more, hackers like to share what they find, they will share all kinds of your personal information.

So you may want to know what can you do? You can ask the following question by yourself:

- Do you store credit card statements in an easy-to-find folder on your computer?

- Do you store your passwords on your computer?

- Do you have a habit of keeping browser windows open on websites, windows that reveal your bank account or credit card numbers?

And Here is a list of tips you can follow to avoid the hackers:

1. Change Your Password

After finding that your email had been hacked, the very first order of business for you was to change secure password. As easy as that may sound, because Google had locked down my account, it was actually quite difficult.

2. Assess the Situation

You should stop and quickly assess what has happened. Try to imagine what could have happened to determine what you need to do next. For example:

Did you use this password elsewhere? If you use the same password in most places, you might have to change all of those which are lots of works to do.

3. Create Fraud Alerts for Your Credit

The first thing you have to do is to call your bank to ask the details behind the security alert.

An alert may make it very hard for you to open a new credit card or get a loan, but it will also eliminate any threat of your identity being used for further harm. The account alert lasts for 90 days and you can let the alert lapse anytime.

4. Set Up 2-Factor Authentication

The next step is to double up on your account security to make sure the situation won’t get worse.

Make sure you activate 2-step authentication for all of your accounts. I know it is a bit annoying, but it’s worth the effort.

Two-factor authentication is becoming an option for many online accounts.

5. Watch Your Accounts Closely

The final step here is to monitor all your accounts.

This should be done these ways:

- Tell All of Your Friends/Family to be on Alert: Tell them about being hacked so if they get weird social media requests from you or a fishy phone call, they know to be careful about what kind of information they give.

- Get Your Free Credit Report: Take advantage of Free Credit Report from your credit bureau. Check if there is information that you don’t recognize.

Consider an Identity Monitoring Service: After getting bored of monitoring your accounts for a certain time, you’ll more than likely start to forget about having been hacked. But the Identity Monitoring Service will maintain vigilant monitoring after you’ve long forgotten about it.

Consider Use a VPN when you take your laptop to a cafe, airport or hotel that anywhere you connect to a public network. Be careful when you’re online. Avoid websites you’re not familiar with. Keep your antivirus software up to date. VPN download

Conclusion

Change all your passwords of the sensitive accounts. Assess the situation and determine what needs to do. Create a fraud alert with the credit bureaus. Set up 2-factor authentication.

When all of these have done, monitor your accounts for any suspicious activity on your account.

Follow these steps will protect your identity and your accounts security.